The Ultimate Guide To Frost Pllc

The Ultimate Guide To Frost Pllc

Blog Article

The Best Strategy To Use For Frost Pllc

Table of ContentsThe 3-Minute Rule for Frost PllcThe Facts About Frost Pllc Uncovered

CPAs are the" large guns "of the audit market and typically don't take care of day-to-day audit jobs. You can make certain all your funds are present which you're in excellent standing with the IRS. Hiring an accounting company is an obvious option for intricate businesses that can afford a licensed tax expert and an outstanding alternative for any local business that intends to minimize the chances of being examined and unload the concern and migraines of tax obligation declaring. Open rowThe distinction between a certified public accountant and an accountant is merely a lawful difference. A certified public accountant is an accountant licensed in their state of operation. Only a CPA can use attestation services, work as a fiduciary to you and work as a tax obligation attorney if you encounter an IRS audit. No matter your scenario, even the busiest accounting professionals can ease the moment problem of submitting your taxes yourself. Jennifer Dublino contributed to this write-up. Source interviews were conducted for a previous variation of this article. Bookkeeping firms might likewise utilize CPAs, however they have other types of accounting professionals on personnel. Commonly, these various other sorts of accounting professionals have specialties across areas where having a certified public accountant license isn't called for, such as management accounting, not-for-profit accountancy, cost bookkeeping, government bookkeeping, or audit. That does not make them less qualified, it simply makes them in a different way certified. For these stricter policies, Certified public accountants have the legal authority to sign audited monetary declarations for the functions of approaching capitalists and securing financing. While bookkeeping firms are not bound by these exact same policies, they have to still abide by GAAP(Normally Accepted Accountancy Concepts )finest techniques and show highhonest criteria. Because of this, cost-conscious little and mid-sized companies will certainly usually make use of a bookkeeping services company to not only meet their accounting and accountancy needs currently, however to range with them as they expand. Don't let the perceived reputation of a business filled with Certified public accountants distract you. There is a misunderstanding that a certified public accountant company will certainly do a much better task due to the fact that they are legitimately permitted to

take on more activities than an accounting business. And when this is the instance, it does not make any type of sense to pay the costs that a certified public accountant firm will charge. In many cases, companies can save money on prices considerably while still having actually top notch work done by making use of an accountancy services like this business rather. As a result, using an accountancy solutions business is frequently a much better value than employing a CPA

The Only Guide to Frost Pllc

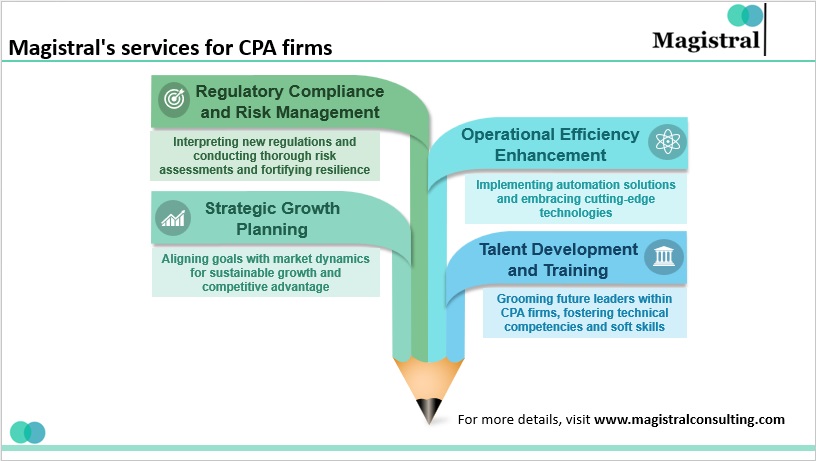

CPAs likewise have proficiency in establishing and refining business plans and treatments and analysis of the practical requirements of staffing designs. A well-connected Certified public accountant can take advantage of their network to help the company in different critical and seeking advice from duties, properly linking the organization to the optimal prospect to meet their needs. Following time you're looking to fill up a click for more board seat, take into consideration getting to out to a CPA that can bring worth to your company in all the methods provided above.

Report this page